Company Info

My Analysis

Research House

Accounting Ratio

My notes based on 2011 quarter 3 report (number in '000):

- The increase in revenue is contributed by the following:

i) Increase in sales volume of shoe sole from approximately 8.9 million pairs in FPE2010 to approximately 11.8 million pairs in FPE2011

ii) Increase in average selling price of shoe sole from RMB105 per pair in FPE2010 to RMB110.6 per pair in FPE2011, and increase in average selling price of apparels from RMB74 per piece in FPE2010 to RMB102.1 per piece in FPE2011

- The increase in selling and distribution expenses mainly due to higher expenses in relation to renovation subsidies for the outlet amounting to RMB14.8 million, display shelf for the outlet amounting to RMB11.8 million and expansion of sales network expenses amounting to RMB38.4 million

- The decrease in revenue was due to a slight decrease in the sales of the shoes, apparels & accessories as the contribution is mainly for Summer/Spring products that has lower selling prices as compared to Autumn/Winter products

- Higher pbt mainly due to the lower selling and distribution costs

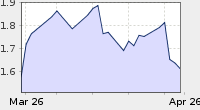

- Estimate next 4Q eps after 2011 Q3 result announced = 0.3154*1.1 = 0.3469, estimate PE on current price 1.16 = 3.27(DPS 0.05)

- Estimate next 4Q eps after 2011 Q1 result announced = 0.3452*1.1 = 0.3797, estimate highest/lowest PE = 3.56/2.82 (DPS 0.05)

- Estimate next 4Q eps after 2010 Q4 result announced = 0.3452*1.1 = 0.3797, estimate highest/lowest PE = 4.87/3.56 (DPS 0.05)

- Estimate next 4Q eps after 2010 Q3 result announced = 0.095*4 = 0.38(0.095 is average of recent 2Q minus little eps due to end of tax exemption and reduction), estimate highest/lowest PE = 4.93/2.91 (DPS 0.025)

- Estimate next 4Q eps after 2010 Q2 result announced = 0.1584*2*1.1 = 0.3485, estimate highest/lowest PE = 3.77/3 (DPS 0.025)

- Estimate next 4Q eps after 2010 Q1 result announced = 0.0834*4 = 0.3336, estimate highest/lowest PE = 4.2/3.15

- Estimate next 4Q eps after 2009 Q4 result announced = 0.4288, estimate highest/lowest PE = 3.59/3.03

XINQUAN latest news (English)

XINQUAN latest news (Chinese)

| Market Capital (Capital Size) | 356,502,800 (Small) |

| Par Value | USD 0.10 |

My Analysis

| Forecast P/E now | (1.16-0.025)/0.3469 = 3.27 (Moderate) |

| Target Price | 1.56+0.025 = 1.59 (PE 4.5, EPS 0.3469, DPS 0.025) |

| Decision | Watching, buy when stock sell quantity low |

| Comment | Revenue decreased 6.4% but higher than preceding year corresponding quarter 8.6%, eps increased 33.4% but lower than preceding year corresponding quarter 9%, no cash generated from operating due to largely increased receivables and still got large expenses of investing, financing expenses use bank borrowings to cover, cash decreasing, weaker liquidity ratio but still at high level now, lower gearing ratio at below moderate level now, high receivables but working capital did not increase, going to dilute around 14% eps due to issuing new shares, new brand GERTOP growing |

| First Support Price | 1.1 |

| Second Support Price | 1.0 |

| Risk Rating | MODERATE |

Research House

| Mercury Target Price | 1.9 (2011-05-19) |

Accounting Ratio

| Return on Equity | 24.82% |

| Dividend Yield | 2.16% |

| Profit Margin | 20.46% |

| Tax Rate | 21.64% |

| Asset Turnover | 1.2949 |

| Net Asset Value Per Share | 1.32 |

| Net Tangible Asset per share | 1.32 |

| Price/Net Tangible Asset Per Share | 0.88 |

| Cash Per Share | 0.55 |

| Liquidity Current Ratio | 3.6562 |

| Liquidity Quick Ratio | 3.4165 |

| Liquidity Cash Ratio | 1.6165 |

| Gearing Debt to Equity Ratio | 0.2757 |

| Gearing Debt to Asset Ratio | 0.2161 |

| Working capital per thousand Ringgit sale | 41.3% |

| Days to sell the inventory | 19 |

| Days to collect the receivables | 102 |

| Days to pay the payables | 47 |

My notes based on 2011 quarter 3 report (number in '000):

- The increase in revenue is contributed by the following:

i) Increase in sales volume of shoe sole from approximately 8.9 million pairs in FPE2010 to approximately 11.8 million pairs in FPE2011

ii) Increase in average selling price of shoe sole from RMB105 per pair in FPE2010 to RMB110.6 per pair in FPE2011, and increase in average selling price of apparels from RMB74 per piece in FPE2010 to RMB102.1 per piece in FPE2011

- The increase in selling and distribution expenses mainly due to higher expenses in relation to renovation subsidies for the outlet amounting to RMB14.8 million, display shelf for the outlet amounting to RMB11.8 million and expansion of sales network expenses amounting to RMB38.4 million

- The decrease in revenue was due to a slight decrease in the sales of the shoes, apparels & accessories as the contribution is mainly for Summer/Spring products that has lower selling prices as compared to Autumn/Winter products

- Higher pbt mainly due to the lower selling and distribution costs

- Estimate next 4Q eps after 2011 Q3 result announced = 0.3154*1.1 = 0.3469, estimate PE on current price 1.16 = 3.27(DPS 0.05)

- Estimate next 4Q eps after 2011 Q1 result announced = 0.3452*1.1 = 0.3797, estimate highest/lowest PE = 3.56/2.82 (DPS 0.05)

- Estimate next 4Q eps after 2010 Q4 result announced = 0.3452*1.1 = 0.3797, estimate highest/lowest PE = 4.87/3.56 (DPS 0.05)

- Estimate next 4Q eps after 2010 Q3 result announced = 0.095*4 = 0.38(0.095 is average of recent 2Q minus little eps due to end of tax exemption and reduction), estimate highest/lowest PE = 4.93/2.91 (DPS 0.025)

- Estimate next 4Q eps after 2010 Q2 result announced = 0.1584*2*1.1 = 0.3485, estimate highest/lowest PE = 3.77/3 (DPS 0.025)

- Estimate next 4Q eps after 2010 Q1 result announced = 0.0834*4 = 0.3336, estimate highest/lowest PE = 4.2/3.15

- Estimate next 4Q eps after 2009 Q4 result announced = 0.4288, estimate highest/lowest PE = 3.59/3.03

XINQUAN latest news (English)

XINQUAN latest news (Chinese)

No comments:

Post a Comment