Company Info

| Market Capital (Capital Size) | 26,740,000 (Very Small) |

| Par Value | RM 0.10 |

My Analysis

| Forecast P/E now | 0.07/0.0013 = 53.85 (High) |

| Target Price | 0.0013*4.0 = 0.01 (PE 4.0, EPS 0.0013) |

| Decision | Not interested unless next quarter report got good result or stock price below SMA20 a lot |

| Comment | Revenue increased 59.8% and was second consecutive quarter increasing and largely higher than preceding year corresponding quarter, eps increased 125% loss and also largely higher loss than preceding year corresponding quarter, cash generated from operating more than enough to cover all financing expenses and generated more cash from financing activity to cover investing expenses but still not enough, weaker liquidity from high to medium level now, lower gearing ratio from low to very low level now, IT division continue contributed high profit |

| First Support Price | 0.06 |

| Second Support Price | 0.05 |

| Risk Rating | HIGH |

Accounting Ratio

| Return on Equity | -3.92% |

| Dividend Yield | - |

| Profit Margin | -45.82% |

| Tax Rate | - |

| Asset Turnover | 0.1159 |

| Net Asset Value Per Share | 0.12 |

| Net Tangible Asset per share | 0.09 |

| Price/Net Tangible Asset Per Share | 0.61 |

| Cash Per Share | 0.0 |

| Liquidity Current Ratio | 3.5881 |

| Liquidity Quick Ratio | 3.4855 |

| Liquidity Cash Ratio | 1.0444 |

| Gearing Debt to Equity Ratio | 0.0988 |

| Gearing Debt to Asset Ratio | 0.0841 |

| Working capital per thousand Ringgit sale | 57.4% |

| Days to sell the inventory | 8 |

| Days to collect the receivables | 184 |

| Days to pay the payables | 70 |

Technical Analysis

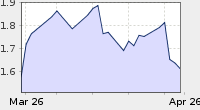

| SMA 20 | 0.063 (Uptrend 18 days) |

| SMA 50 | 0.058 (Uptrend) |

| SMA 100 | 0.055 (Uptrend) |

| SMA 200 | 0.057 (Same) |

| MACD | 0.003064 (Uptrend 4 days) |

| MACD Histogram | 0.001009 (Uptrend 18 days) |

My notes based on 2012 quarter 3 report (number in '000):-

- Higher revenue than FY11Q3 due mainly to sales of its IT division

- Higher loss mainly due to the write-off of certain research pilots as well as the plantation cost of approximately RM639,000 and RM180,000 respectively arising from the failed paddy plantation in Cambodia this season due to the unprecedented massive flooding affecting not only Cambodia but also Thailand

- Lower revenue than FY12Q2 mainly due to lower sales of its IT division

- Estimate next 4Q eps after 2012 Q3 result announced = 46532*0.01/360681 = 0.0013(if can achieve ROE of 1%), estimate PE on current price 0.07 = 53.85

- Estimate next 4Q eps after 2012 Q2 result announced = 0.0012*4 = 0.0048, estimate highest/lowest PE = 13.54/8.33

- Estimate next 4Q eps after 2012 Q1 result announced = 0.0004*4*1.05 = 0.0017, estimate highest/lowest PE = 44.12/23.53

- Estimate next 4Q eps after 2011 Q4 result announced = (0.001+0.0023)/2 = 0.0017, estimate highest/lowest PE = 47.06/32.35

- Estimate next 4Q eps after 2011 Q3 result announced = 0.0042, estimate highest/lowest PE = 20.24/13.1

- Estimate next 4Q eps after 2011 Q2 result announced = 0.0042, estimate highest/lowest PE = 19.05/14.29

- Estimate next 4Q eps after 2011 Q1 result announced = 0.0036+0.0006(average of eps per quarter in year 2009)*4 = 0.006, estimate highest/lowest PE = 14.17/10.08

ASIABIO latest news (English)

ASIABIO latest news (Chinese)

No comments:

Post a Comment