Listing Date: 11.01.1982

Market: MAIN

Sector: TRADING/SERVICES

Par Value: 1.00

Major Industry: Recreation

Sub Industry : Miscellaneous Recreation

Market Cap : 1077748654*2.17 = 2,338,714,579.18 (Large)

NTA per share : (2237915-2892231)/1068625 = Negative

P/BV : Not Applicable

Forecast P/E now : (2.17-0.05)/0.2139 = 9.91 (Moderate)

ROE : 11.08% (Moderate)

DY : 0.05/2.17*100 = 2.3% (Low)

Fixed Asset Turnover(3 year) : (0.5976+0.5526+0.545)/3 = 0.565 (Low)

Liquidity Ratio : 1701090/712982 = 2.3859 (Moderate)

Receivables Collection Period : (415128+347035)/2/(3552183/365) = 39 days (Acceptable)

My Target Price : 2.14+0.05 = 2.19 (EPS 0.2139, PE 10, DPS 0.05)

My Decision : NOT BUY unless price below 2

My Comment : Revenue and profit increased compared to last year, strong cash, high debt but got slightly decreased, navps increased, possible of new income stream from property division, stockbroking division expect downstream

Technical Support Price : 2.1

Risk Rating : MODERATE

MULTI-PURPOSE HOLDINGS BERHAD is engaged in the core businesses of financial services, stock broking and gaming. The principal activities consist of investment holding and trading, operation of general insurance business, provision of leasing, hire purchase, factoring and general loan financing services, operation and management of a licensed four digit numbers forecast betting game, operation of hotels and of a golf club, securities broking and dealing, designing and construction of railway and related activities, property development, provision of share registration and management services, printing activities, and provision of computer software and other related services. In March 2008, it incorporated a wholly owned offshore subsidiary, Multi Purpose International Limited. In June 2008, the Company acquired Caribbean Gateway Sdn Bhd.

My notes based on 2010 quarter 2 report (number in '000):-

- The PBT for the current quarter was 33% lower than the previous corresponding quarter. The difference was mainly due to the exceptional gains from the disposal of quoted investments and dividend income totaling RM74.6 million received in the previous corresponding quarter

- The PBT of the Gaming Division achieved in the current quarter has dropped slightly(8.6%) when compared to the previous corresponding period. After discounting the exceptional items in the previous corresponding quarter, coupled with lower finance costs this quarter and additional contribution from the 4D Jackpot game which was introduced in September 2009, the Gaming Division has performed better in this quarter

- The Financial Services Division achieved 42.6% higher PBT compared to the previous corresponding financial quarter. The favourable result was mainly due to the improved underwriting performance due to tightening of underwriting especially in non-performing classes and greater emphasis on risk management and selection

- Lower brokerage income and provision for doubtful debts had affected the performance of the Stockbroking Division. As a result, the Division registered a loss before taxation of RM3.5 million as compared to the PBT of RM10.2 million achieved in the previous corresponding financial quarter

- The Group's PBT has dropped by 10% from the previous corresponding financial period

- The Group recorded a 12.9% lower PBT as compared to the immediate preceding quarter. The reduction in PBT is mainly due to the recognition of losses on the fair value of the derivative liability and quoted investments within the Group

- Estimate next 4Q eps after 2010 Q2 result announced = 0.0563*4*0.95 = 0.2139, estimate PE on current price 2.17 = 9.91(DPS 0.05)

- Estimate next 4Q eps after 2010 Q1 result announced = 0.22*1.05 = 0.231 (5% grow adjustment from 0.22 due to positive result), estimate highest/lowest PE = 9.39/7.84 (DPS 0.09)

- Estimate next 4Q eps after 2009 Q4 result announced = 0.05*4 = 0.2*1.1 = 0.22 (10% grow from 0.2, due to 4D Jackpot game and current economic environment, result exclude other income), estimate highest/lowest PE = 11.05/8.27 (DPS 0.1, correction to last quarter estimated)

MPHB latest news (English)

MPHB latest news (Chinese)

| a_date | year | qrt | h_price | l_price | div | roe | c_roe | rev | c_rev | pbt | c_pbt | prof | c_prof | eps | c_eps | asset | liab | mino | equi | cfo | cfi | cff | cash | fcf | net | final | share | c_share | market | date | prof_m | pe | de | navps | vat |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2010-08-26 | 2010 | 2 | N/A | N/A | - | 0.0221 | 0.0471 | 871360 | 1863980 | 122930 | 261934 | 60137 | 128330 | 0.0563 | 0.1201 | 5944254 | 3220365 | 485974 | 2723889 | 304199 | -251959 | -127236 | 805415 | 52240 | -74996 | 730419 | 1068625 | 1068625 | 2286857 | 2010-06-30 | 0.1411 | - | 1.1823 | 2.09 | 0.2193 |

| 2010-05-21 | 2010 | 1 | 2.26 | 1.9 | - | 0.0259 | 0.0259 | 992620 | 992620 | 139004 | 139004 | 68193 | 68193 | 0.0633 | 0.0633 | 5905343 | 3276166 | 454887 | 2629177 | 40337 | -38483 | -45193 | 757909 | 1854 | -43339 | 714570 | 1076718 | 1076718 | 2131901 | 2010-03-31 | 0.14 | - | 1.2461 | 2.02 | 0.2404 |

| 2010-02-25 | 2009 | 4 | 2.48 | 1.87 | 0.05 | 0.0438 | 0.1295 | 874959 | 3323417 | 136586 | 486657 | 114230 | 337387 | 0.1086 | 0.3207 | 5826508 | 3221050 | 439366 | 2605458 | 624210 | -156742 | -178144 | 468940 | 467468 | 289324 | 758264 | 1052079 | 1052079 | 2030512 | 2009-12-31 | 0.1561 | 6.0183 | 1.2363 | 2.06 | 0.1623 |

| 2009-11-25 | 2009 | 3 | 1.96 | 1.75 | - | 0.0199 | 0.0876 | 813244 | 2448458 | 64556 | 350071 | 50727 | 223157 | 0.0499 | 0.2195 | 5805712 | 3258468 | 473680 | 2547244 | 462533 | -170190 | -141515 | 468940 | 292343 | 150828 | 619768 | 1016649 | 1016649 | 1931633 | 2009-09-30 | 0.0794 | - | 1.2792 | 2.04 | 0.2011 |

| 2009-08-26 | 2009 | 2 | 2.16 | 1.8 | 0.04 | 0.0497 | 0.0673 | 804013 | 1635214 | 182320 | 285515 | 127406 | 172430 | 0.1255 | 0.1698 | 5829719 | 3267012 | 479466 | 2562707 | 447449 | -111902 | -131861 | 468940 | 335547 | 203686 | 672626 | 1015399 | 1015399 | 2101875 | 2009-06-30 | 0.2268 | - | 1.2748 | 2.05 | 0.0482 |

| 2009-05-26 | 2009 | 1 | 2.1 | 1.32 | - | 0.0180 | 0.0180 | 831201 | 831201 | 103195 | 103195 | 45024 | 45024 | 0.0464 | 0.0464 | 5776956 | 3276616 | 547320 | 2500340 | 149392 | -91057 | 57762 | 468940 | 58335 | 116097 | 585037 | 970209 | 970209 | 1338888 | 2009-03-31 | 0.1242 | - | 1.3105 | 2.01 | 0.2743 |

| 2009-02-20 | 2008 | 4 | 1.49 | 1.02 | 0.05 | 0.0083 | 0.0666 | 827066 | 3137244 | 72561 | 262864 | 19772 | 158618 | 0.0173 | 0.1389 | 5645839 | 3263297 | 518025 | 2382542 | 522494 | -315915 | -178237 | 440598 | 206579 | 28342 | 468940 | 1141937 | 1141937 | 1199033 | 2008-12-31 | 0.0877 | 7.5593 | 1.3697 | 1.63 | 0.0633 |

| 2008-11-19 | 2008 | 3 | 1.21 | 1.0 | - | 0.0150 | 0.0521 | 759149 | 2310820 | 39057 | 195962 | 41025 | 142300 | 0.0358 | 0.1241 | 5698139 | 2967808 | 865441 | 2730331 | 29234 | 35830 | 82985 | 440598 | 65064 | 148049 | 588647 | 1146994 | 1146994 | 1204343 | 2008-09-30 | 0.0514 | - | 1.087 | 1.63 | 0.0877 |

| 2008-08-27 | 2008 | 2 | 1.46 | 0.96 | 0.04 | 0.0104 | 0.0203 | 753961 | 1551029 | 73886 | 154700 | 52036 | 101275 | 0.0453 | 0.0881 | 5762907 | 772733 | 856558 | 4990174 | 68525 | 78368 | 182315 | 440598 | 146893 | 329208 | 769806 | 1149899 | 1149899 | 1621357 | 2008-06-30 | 0.098 | - | 0.1549 | 3.59 | 0.4081 |

| 2008-05-28 | 2008 | 1 | 1.82 | 1.36 | 0.05 | 0.0181 | 0.0181 | 797068 | 797068 | 80814 | 80814 | 49239 | 49239 | 0.0427 | 0.0427 | 3654043 | 934015 | 839761 | 2720028 | 9881 | 9372 | 11356 | 440598 | 19253 | 30609 | 471207 | 1153866 | 1153866 | 2100036 | 2008-03-31 | 0.1014 | - | 0.3434 | 1.63 | 0.3145 |

| 2008-02-29 | 2007 | 4 | 2.05 | 1.56 | 0.06 | 0.0178 | 0.1476 | 783240 | 3206046 | 72723 | 684184 | 46998 | 389350 | 0.0407 | 0.3375 | 3766487 | 1129282 | 807805 | 2637205 | -424030 | 442252 | -435792 | 858168 | 18222 | -417570 | 440598 | 1153706 | 1153706 | 2376634 | 2007-12-31 | 0.0928 | 6.1041 | 0.4282 | 1.59 | 0.0421 |

| 2007-11-16 | 2007 | 3 | 2.59 | 1.88 | - | 0.0193 | 0.1345 | 806365 | 2422806 | 105151 | 611461 | 49083 | 342352 | 0.0425 | 0.2968 | 3721064 | 1175173 | 847344 | 2545891 | 119920 | 253071 | -847222 | 858168 | 372991 | -474231 | 383937 | 1153652 | 1153652 | 2976422 | 2007-09-30 | 0.1304 | - | 0.4616 | 1.47 | 0.2823 |

| 2007-08-21 | 2007 | 2 | 2.58 | 2.14 | - | 0.0447 | 0.1099 | 791614 | 1616441 | 160699 | 506310 | 119196 | 293269 | 0.1033 | 0.2542 | 4202463 | 1534795 | 1013745 | 2667668 | 261845 | 478616 | -627821 | 858168 | 740461 | 112640 | 970808 | 1153548 | 1153548 | N/A | 2007-06-30 | 0.203 | - | 0.5753 | 1.43 | 0.1638 |

| 2007-05-21 | 2007 | 1 | N/A | N/A | 0.05 | 0.0588 | 0.0588 | 824827 | 824827 | 345611 | 345611 | 174073 | 174073 | 0.1509 | 0.1509 | 4855466 | 1896839 | 1386388 | 2958627 | 85239 | 398769 | -74980 | 858168 | 484008 | 409028 | 1267196 | 1153230 | 1153230 | 2675493 | 2007-03-31 | 0.419 | - | 0.6411 | 1.36 | 0.1414 |

| 2007-02-15 | 2006 | 4 | N/A | N/A | - | 0.0210 | 0.0611 | 291153 | 451627 | 83175 | 199750 | 56807 | 164932 | 0.0492 | 0.1429 | 4168686 | 1467873 | 1302191 | 2700813 | 625272 | -226067 | 301944 | 157019 | 399205 | 701149 | 858168 | 1153867 | 1153867 | 1523104 | 2006-12-31 | 0.2857 | 9.2347 | 0.5435 | 1.21 | 0.2423 |

| year | qrt | Assets held for sale (A-0) | Deferred tax assets (A-0) | Intangible assets (A-0) | Intellectual property (A-0) | Investment in associated companies (A-0) | Investment properties (A-0) | Land held for property development (A-0) | Other investments (A-0) | Prepaid lease payments (A-0) | Property, plant and equipment (A-0) | Receivables (A-0) | Securities Held-to-Maturity (A-0) | Cash and cash equivalents (A-1) | Current asset classified as held for sales (A-1) | Current tax assets (A-1) | Deposits with licensed banks (A-1) | Inventories (A-1) | Loans to customers (A-1) | Other investments (A-1) | Other receivables (A-1) | Trade receivables (A-1) | Deferred tax liabilities (L-0) | Derivative liabilities (L-0) | Loans & borrowings (L-0) | Provision for retirement benefits (L-0) | Redeemable convertible unsecured loan stocks (L-0) | Reserves for unexpired risks (L-0) | Current tax liabilities (L-1) | Exchangeable bonds (L-1) | Liabilities directly associated with assets classified as held for sale (L-1) | Loans & borrowings (L-1) | Other payables (L-1) | Minority interest (M-1) |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2010 | 2 | 159917 | 115585 | 2892231 | - | 106519 | 642660 | - | 98363 | 3880 | 185176 | 33833 | 5000 | 514337 | 259398 | 123741 | 383177 | 5309 | - | - | 415128 | - | 19913 | 28977 | 1911934 | 643 | 460116 | 85800 | 23757 | - | - | 1722 | 687503 | 485974 |

| 2010 | 1 | 13222 | 114736 | 2891551 | 657 | 106743 | 638967 | - | 297182 | 3895 | 190400 | 33833 | - | 104234 | 156730 | 111701 | 707519 | 5180 | - | - | 528793 | - | 19825 | 34446 | 1949981 | 644 | 471195 | 84662 | 16696 | - | - | 2536 | 696181 | 454887 |

| 2009 | 4 | - | 120533 | 2891863 | - | 106343 | 640750 | - | 271955 | 3906 | 194364 | 33833 | - | 51699 | - | 103835 | 958847 | 5344 | - | - | 443236 | - | 22498 | - | 1991299 | 659 | 482274 | 81572 | 7254 | - | - | 314 | 635180 | 439366 |

| 2009 | 3 | - | 120061 | 2891094 | - | 106078 | 545276 | 22178 | 269668 | 3919 | 200000 | 36738 | - | 119020 | 234873 | 99698 | 835674 | 5682 | - | - | 315753 | - | 20379 | - | 1988715 | 674 | 493018 | 80271 | 2843 | - | 4387 | 6241 | 661940 | 473680 |

| 2009 | 2 | - | 126850 | 2890884 | - | 105293 | 539995 | 22178 | 197201 | 3930 | 209694 | 36593 | - | 137548 | 237623 | 76375 | 892549 | 5971 | - | - | 347035 | - | 20379 | - | 2049186 | 654 | 503764 | 80507 | 662 | - | 6454 | 4645 | 600761 | 479466 |

| 2009 | 1 | - | 125485 | 2890884 | - | 104372 | 540121 | 18372 | 126138 | 3943 | 204433 | 39966 | - | 122933 | 241337 | 62439 | 860771 | 5797 | - | - | 429965 | - | 20379 | - | 2098122 | 653 | 514185 | 72507 | 431 | - | 14008 | 7138 | 549193 | 547320 |

| 2008 | 4 | - | 136332 | 2890463 | - | 104509 | 541074 | - | 127876 | 3955 | 201164 | 39966 | - | 59013 | 242332 | 72128 | 762164 | 6297 | - | - | 458566 | - | 24468 | - | 2095381 | 653 | 524607 | 72452 | 315 | - | 6682 | 28136 | 510603 | 518025 |

| 2008 | 3 | - | 8439 | 2947615 | - | 123115 | 592457 | 20000 | 98796 | 1008 | 180693 | 39864 | - | 112129 | 389925 | 40631 | 742567 | 5203 | 99451 | - | 296246 | - | 12006 | - | 2200000 | 2682 | - | 74243 | 7255 | - | 118231 | 4641 | 548750 | 865441 |

| 2008 | 2 | - | 8439 | 2916077 | - | 122388 | 414963 | 128322 | 75760 | 4690 | 184976 | 39864 | - | 213975 | 404925 | 10807 | 814990 | 7106 | 93359 | - | 322266 | - | 11996 | - | - | 2540 | - | 74582 | 7656 | - | 118231 | 4536 | 553192 | 856558 |

| 2008 | 1 | - | 9182 | 755914 | - | 130551 | 519962 | 131921 | 484777 | 1007 | 264227 | 39864 | - | 130735 | - | 13953 | 629447 | 8707 | 183829 | 10959 | 339008 | - | 13627 | - | - | 2649 | - | 68740 | 6890 | 121520 | - | 269767 | 450822 | 839761 |

| 2007 | 4 | - | 13621 | 800439 | - | 130861 | 622732 | 20000 | 530281 | 585 | 274757 | 39864 | - | 50831 | - | 31472 | 718688 | 9000 | 188565 | - | 334791 | - | 18075 | - | 102861 | 1616 | - | 65129 | 11346 | 260500 | - | 156172 | 513583 | 807805 |

| 2007 | 3 | - | - | 759245 | - | 132773 | 525285 | 77004 | 526255 | 46572 | 211711 | - | - | 249914 | 36000 | 21471 | 400636 | 9568 | 387347 | - | 275122 | 62161 | 15958 | - | 106752 | 1217 | - | 61256 | 30300 | 260500 | - | 173991 | 525199 | 847344 |

| 2007 | 2 | - | - | 746455 | - | 132117 | 607805 | 24356 | 480438 | 43808 | 173307 | - | - | 866971 | 36000 | 17573 | 400661 | 8328 | 331599 | - | 269247 | 63798 | 16150 | - | 145000 | 1167 | - | 59682 | 28461 | 260500 | - | 306996 | 716839 | 1013745 |

| 2007 | 1 | - | - | 819543 | - | 130715 | 592676 | 20000 | 409667 | - | 208291 | - | - | 1148201 | 36000 | 17261 | 385650 | 7934 | 763608 | - | 247178 | 68742 | 15951 | - | 363974 | - | - | 61432 | 32017 | 265500 | - | 250169 | 907796 | 1386388 |

| 2006 | 4 | - | - | 547639 | - | 132781 | 535076 | 20000 | 664588 | 44191 | 220114 | - | - | 61517 | 242933 | 19346 | 1024842 | 8257 | 332520 | - | 297456 | 17426 | 16064 | - | 356612 | 1753 | - | 53613 | 13100 | 300000 | - | 297118 | 429613 | 1302191 |

| year | qrt | Revenue | Income tax expense | Cost of sales | Finance/interest costs | Other income/expenses | Administrative/Operating expenses | Minority interest | Share of profit/ (loss) of associates | Discontinued operation | After tax effect of interest on exercise of warrants |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 2010 | 2 | 871360 | -26953 | -672826 | -36464 | -25096 | -16552 | -35840 | 651 | 1857 | - |

| 2010 | 1 | 992620 | -33415 | -792278 | -22823 | -22053 | -17612 | -37396 | 1150 | - | - |

| 2009 | 4 | 874959 | -22167 | -676797 | -40776 | 29221 | -17757 | -189 | 1545 | -33809 | - |

| 2009 | 3 | 813244 | -12982 | -685523 | -34274 | -18127 | -8866 | -847 | 785 | -2683 | - |

| 2009 | 2 | 804013 | -8779 | -631345 | -45410 | 73505 | -19529 | -46135 | 821 | 265 | - |

| 2009 | 1 | 831201 | -28303 | -645780 | -42580 | -17762 | -19536 | -29868 | -137 | -2211 | - |

| 2008 | 4 | 827066 | -4594 | -642494 | -52067 | -20665 | -38231 | -48195 | -1048 | 0 | - |

| 2008 | 3 | 759149 | -3425 | -619802 | -38515 | -49389 | -14703 | 5393 | 1209 | - | 1108 |

| 2008 | 2 | 753961 | -30151 | -613071 | -1424 | -17423 | -17063 | 8301 | 392 | -32634 | 1148 |

| 2008 | 1 | 797068 | -25418 | -651999 | -4502 | 9616 | -19741 | -6157 | 184 | -51010 | 1198 |

| 2007 | 4 | 783240 | -3063 | -605958 | -7568 | -60458 | -38741 | -22662 | 1080 | - | 1128 |

| 2007 | 3 | 806365 | -29687 | -636406 | -9806 | -40445 | -17050 | -26381 | 1366 | - | 1127 |

| 2007 | 2 | 791614 | -26319 | -689980 | -14065 | 90614 | -19948 | -15184 | 1393 | - | 1071 |

| 2007 | 1 | 824827 | -48871 | -616482 | -14226 | 169865 | -19791 | -122667 | 234 | - | 1184 |

| 2006 | 4 | 291153 | -20150 | -208615 | -9954 | -8695 | -25442 | -6218 | 43475 | - | 1253 |

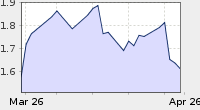

1-Year Historical Daily Chart

5-Year Historical Weekly Chart

1 comment:

Hi

It's me again (the one who commented on MMC).

Once again, I see that you have not taken the potential catalysts that are likely to drive the share price higher into consideration - Magnum's re-listing, strong likelihood of them being allowed to lower the prize payouts to offset the pool betting hike, their iconic development plan in Golden Triangle, property development plans with BRDB, etc.

Regards,

M

Post a Comment